The receding tide of oil price foreshadows the incoming DEFLATION TSUNAMI.

Contrary to the main stream message that all is well with our new oil supply glut, the falling price of oil exposes the current fragility of the global economy.

Nothing grows indefinitely in a finite system, not even debt!

Almost all (90%) of ‘money’

in existence today is debt (credit)[i].

This debt is created from thin air with every form of loan, from credit cards,

through corporate debt to Treasury Notes. All this debt comes with an interest

component that demands never ending growth in order to repay it. Again, the current monetary system REQUIRES that

we have never ending economic growth.

It is one massive pyramid scheme because, if we ever stop

growing, who is paying the interest?

Total U.S. debt has soared over the last 35

years:

Debts are claims on future

goods and services with interest and are essentially a bet that the future

economy will be bigger than the present.

However:

The economy is the

summation of all goods and services and these are produced from work.

High order energy is

required for work.[ii]

Oil is the master high

order energy resource powering 95% of transport in our trade based economic

paradigm.[iii]

Therefore

increasing debts are, in part, a bet that oil production will increase

indefinitely.

But NOTHING grows

indefinitely in a finite system!

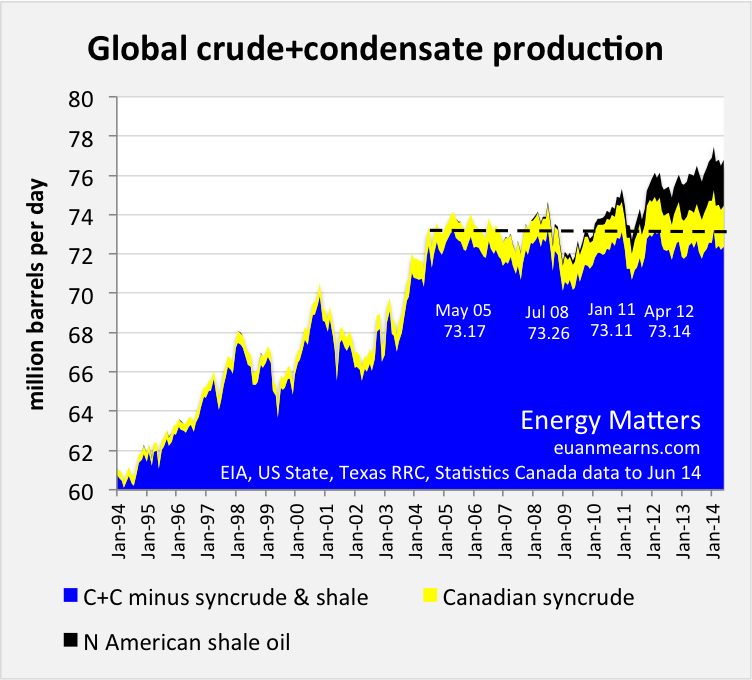

World conventional oil production

(blue) has been on a bumpy plateau since 2005.[iv]

And

the economy, which is derived from work, from high

order energy, to service that exponential debt, has been constrained by the bumpy plateau of conventional oil since

2005.

What

happens when we can no longer service the growing debt with real economic growth?

The great recession

happens. Without real growth, central banks desperately print money (more debt)

by the trillions and hold interest rates close to zero (Q.E.), in an attempt to

heist future growth and to ease the pain of the existing debt. But prescribing

more debt to cure debt only digs the hole deeper and means that even more real growth is required

(read: more work, more energy).

The world is now absolutely

loaded up to the eyeballs with debt, after every sector and every asset class of

the economy has been force fed to the point of glutinous bursting[v].

Newly printed debt produces less and less growth as credit intensity increases.[vi]

And

what happens when the central banks policies cannot reduce interest rate

further and the newly created debt does not increase real goods and services?

This is when deflation

wins and this is where we are.[vii]

Without ongoing real growth,

the exponential power of existing debt erodes the purchasing power of participants

in the global economy. With fewer discretionary dollars to spend into the

economy, a self-feeding loop of demand destruction ensues. Demand for real

goods and services falls.

Demand

for commodities, the primary resources that produce the

real goods and services of the economy, is

now falling:

A recent zero-hedge

article notes that commodities are now experiencing a “Depression-Level

Collapse in Demand”[viii]

Bloomberg: “Iron Ore Slumps to Five-Year Low as China

Slowdown Curbs Demand”[ix]

Sydney Morning Herald “Glencore, the world's fourth largest

mining company and world's biggest commodity trader, will suspend its

Australian coal business for three weeks "in a move never before seen in the Australian market, to avoid pumping tons

into a heavily oversupplied market at depressed prices." [x]

Bloomberg: “Jiangxi Copper Profit Falls as Slowing

China Growth Curbs Demand”[xi]

Fox:

“IEA Cuts Demand Outlook, Oil Continues

Drop”[xii]

Now

back to the master commodity, oil.

Demand for oil, the

primary energy component of the global economy, has always been highly

correlated to GDP[xiii]:

In

our economy of false signals, (Central Bank inflated

stocks, a Quantitative Eased Bond Market, mind-numbingly exotic derivatives, quirky

University of Michigan numbers, manipulated CPIs, arbitrary debt ceilings, smashed

VIXs , etc. etc.) OIL is screaming the

truth.

Price is falling because demand is falling because the real economy is contracting.

Deflation is coming and The Pyramid Scheme of Our Age is about to unravel.

When

the oil tide recedes, prepare for the crash of the GREAT DEFLATION TSUMANI.

[i] http://en.wikipedia.org/wiki/Money_creation

[ii] http://en.wikipedia.org/wiki/Work_%28physics%29

[iii] http://www.ucsusa.org/clean_vehicles/why-clean-cars/oil-use#.VJINxCvF-tY

[iv] http://www.resilience.org/stories/2014-04-13/did-crude-oil-production-actually-peak-in-2005

[v] http://www.economist.com/content/global_debt_clock?page=7

[vi] http://www.bloombergview.com/articles/2014-08-22/larry-summers-is-on-to-something

[vii] http://www.peakprosperity.com/blog/89523/deflation-winning

[viii]

http://www.zerohedge.com/news/2014-11-14/depression-level-collapse-demand-historic-first-glencore-shuts-coal-mines-3-weeks

[ix] http://www.bloomberg.com/news/2014-12-17/iron-ore-slumps-to-five-year-low-as-china-slowdown-curbs-demand.html

[x] http://www.smh.com.au/business/mining-and-resources/glencore-shuts-down-coal-mines-for-three-weeks-20141114-11mhp2.html

[xi] http://www.bloomberg.com/news/2014-10-28/jiangxi-copper-profit-falls-as-slowing-china-growth-curbs-demand.html

[xii] http://www.foxbusiness.com/markets/2014/12/12/iea-cuts-demand-outlook-oil-continues-drop/

[xiii]

http://www.usfunds.com/investor-library/frank-talk/the-strong-link-between-gdp-and-oil-consumption/#.VJIR3CvF-tY